Published on 29.11.2023

CLEPA DATA DIGEST #11 – EU auto supply industry faces job losses as global competition intensifies

Edition #11 – DATA DIGEST is CLEPA’s monthly publication shedding light on the health and resilience of the European automotive supply industry through latest facts and figures

EU auto supply industry faces job losses as global competition intensifies

A call for reinforcing the EU single market

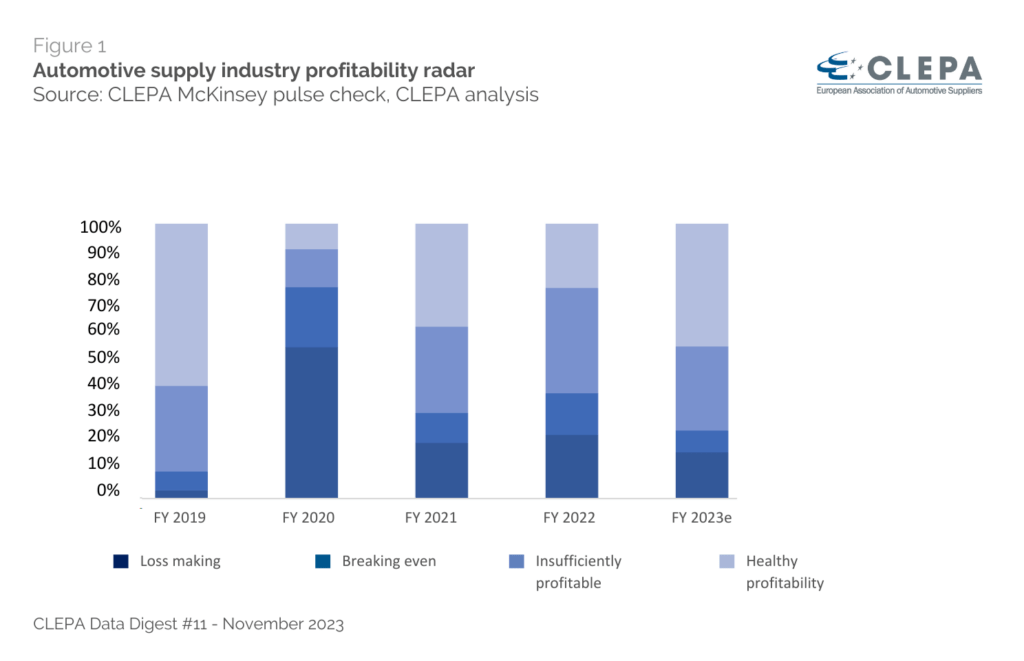

In the wake of years marked by supply chain disruptions and other challenges, a growing number of suppliers are showing strong signs of recovery. Driven by increased global and EU vehicle production and strategic cost-cutting measures, many suppliers are experiencing a resurgence in profitability – an essential condition for their ability to invest. Roughly one-third of these suppliers are successfully navigating the competitive Chinese market, while supplying both local and global markets.

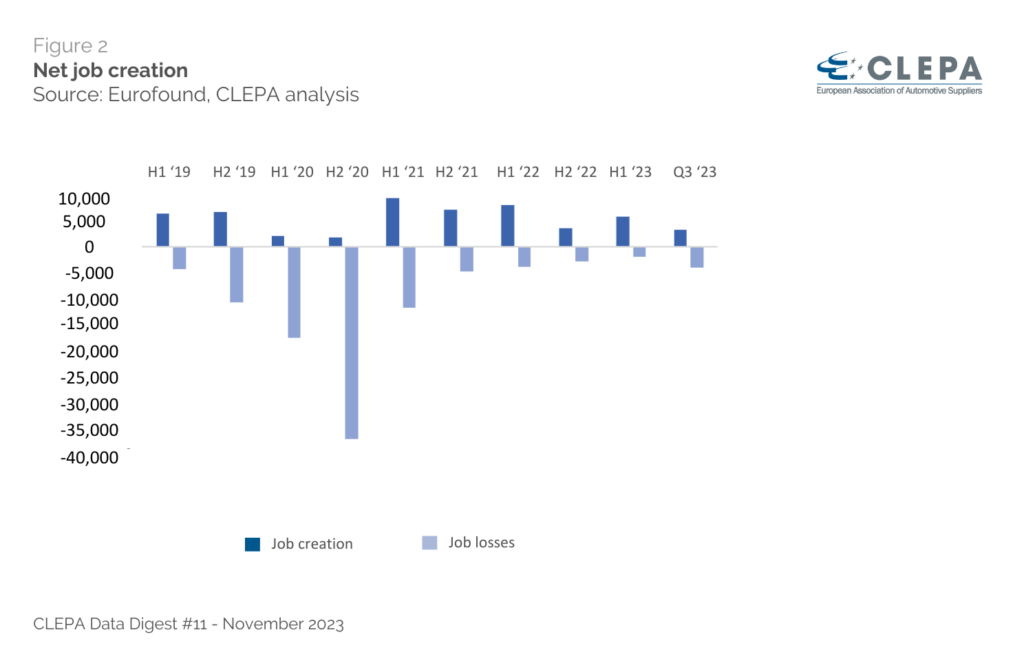

However, the industry’s outlook is mixed, with over half of suppliers still grappling with a less optimistic reality. Factors such as persistent profitability challenges, lower EU production volumes compared to pre-pandemic levels, and a delicate European foothold in the vital Chinese market show a bigger threat than just four years ago. Despite ongoing investments and job creation efforts by automotive suppliers, job losses have begun to outnumber job creation over the last quarter.

What you will find in this edition

Challenges on the Chinese market have led automotive suppliers to find new export markets, and many suppliers have recovered their profitability to more sustainable levels. Nevertheless, the business environment remains challenging, with job creation and EU market investments falling short of expectations.

Nils Poel

CLEPA’s Head of Market Affairs

In 2022, 76% of suppliers recorded a profitability level below what can sustain long-term investment capabilities. The landscape looks better this year, with 44% operating at healthier levels, including 18% with profits even exceeding 10%. Despite this progress, 56% of suppliers still operate with a profitability level below 5%. Operational profitability is a crucial indicator at capital markets. Companies with an operational profitability above 5% are more likely to maintain investments in the transformation. Essential given the more than €20 billion of annual investment required in the transition to eMobility alone.

In the first nine months of 2023, automotive suppliers generated 9,040 jobs across the EU, slightly surpassing the 5,750 jobs lost due to reorganisations. However, the third quarter witnessed a turning point as net job creation turned negative, with an additional 3,900 jobs affected by reorganisations – the highest monthly pace of job loss since 2021.

As of now, automotive suppliers have created 53,850 jobs since 2019, yet this positive effect is overshadowed by the loss of 96,870 jobs during the same period. Forecasts from 2021 suggested a net job creation of 101,000 by 2025, driven by electrification and a stricter Euro 7 regulation. However, the reality falls short of expectations, with the current job growth revealing a significant gap, especially in the EV domain, where projections anticipated 93,700 jobs – clearly underscoring the challenge to meet expected employment benchmarks.

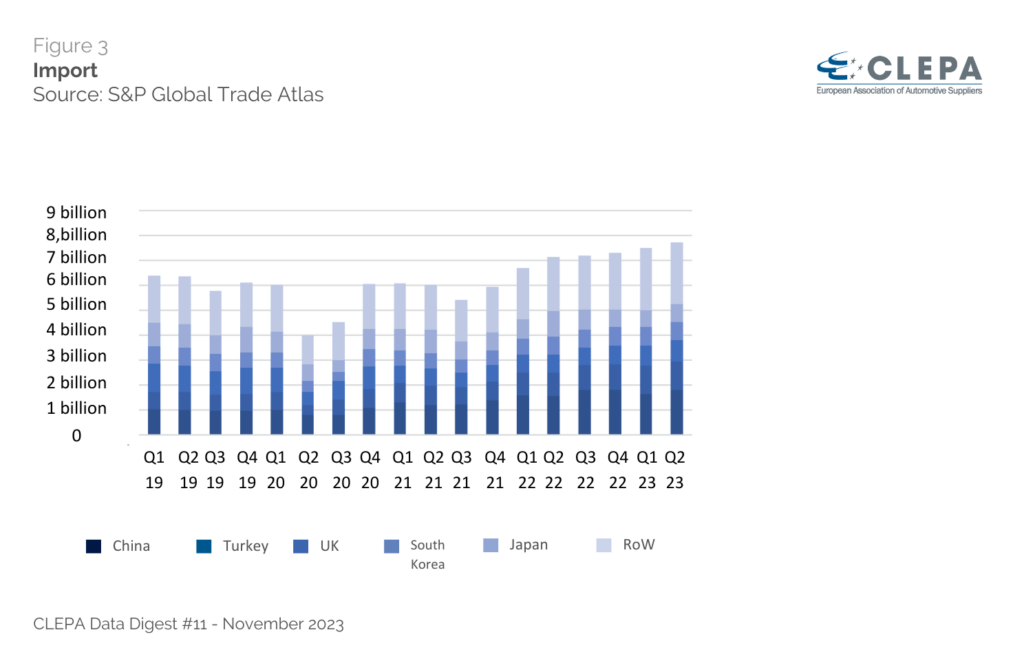

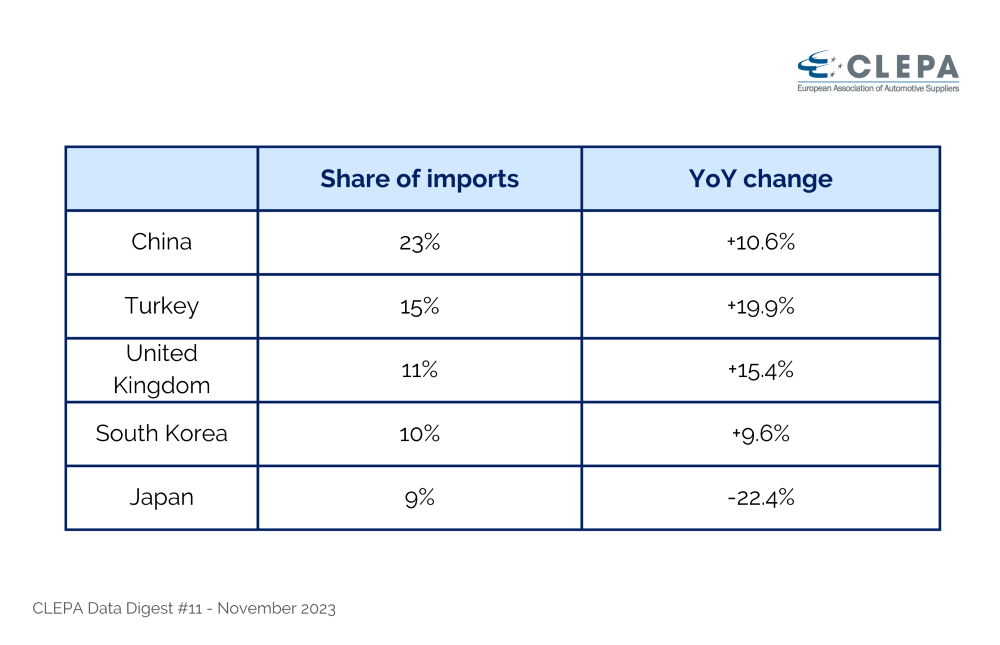

During the first six months of 2023, the EU witnessed a notable uptick in imported automotive components, totalling €15.2 billion – an impressive 10% increase compared to the prior year and a substantial 20% rise since 2019. However, the momentum in import growth experienced a slowdown during Q2, marking the third consecutive quarter of deceleration. This shift can be attributed, in part, to higher vehicle production, a key factor influencing the import landscape. Looking ahead, recent forecasts suggest a potential 12.5% increase in EU vehicle production for 2023 compared to the previous year, highlighting the evolving dynamics in the automotive sector.

Exports and investments abroad remain crucial to the automotive industry, and regional protectionism will not be the answer for regaining Europe’s competitive edge. European policymakers should instead focus on reinforcing the factors which enable businesses in the EU to thrive globally.

Benjamin Krieger

CLEPA’s Secretary General

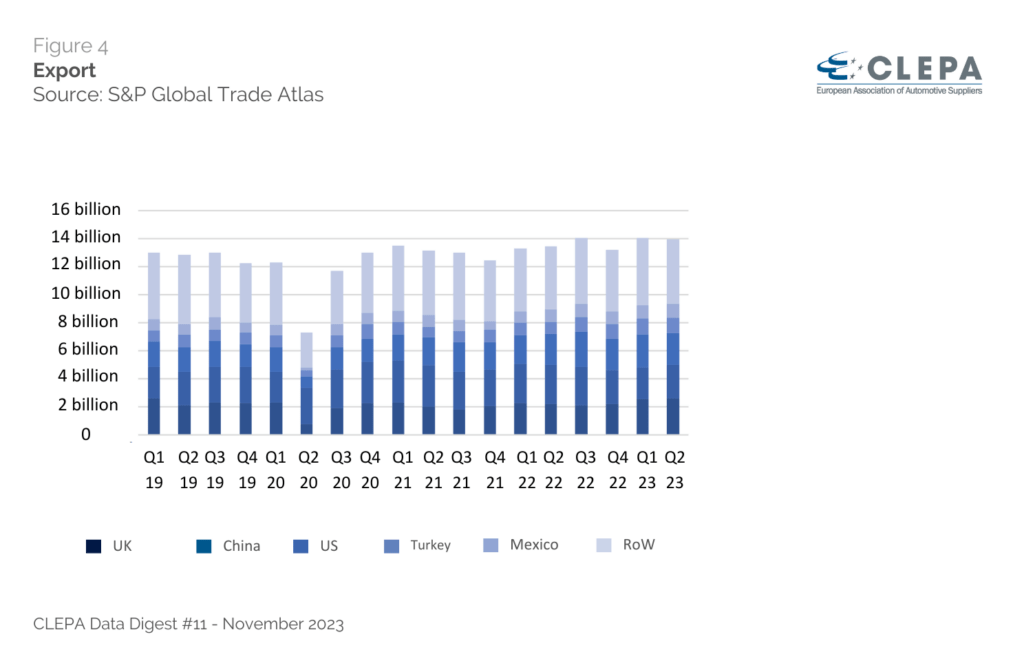

Exports from EU automotive suppliers have reached €28 billion in the first half of 2023, a 4% increase compared to the same period in the prior year, and an 8% increase since 2019. While the trade surplus remains largely stable at €12.8 billion, down from €12.9 billion in the same period last year, a noteworthy shift is evident in China.

Exports to China have been falling for three consecutive quarters, dropping by 16% over the first six months of 2023 compared to 2022. Despite this downturn, the sector showed resilience through strong growth in exports to UK, US, Mexico and Turkey – a testament to the sector’s adeptness in securing new markets.

In a competitive global landscape, 71% of suppliers are actively working to reduce their dependency on the Chinese market, while 29% are actively seeking to expand their activities. This strategic shift aligns with the reality that China represents roughly one–third of the automotive market, while European production is no longer expected to recover to pre-COVID volumes. Furthermore, the Chinese market is a crucial market to test digital innovation, both at product and production level. Production in China forces suppliers to accelerate their product development cycles and improve user experience (e.g. digital applications). The 29% represents suppliers recognised as highly competitive in the Chinese market, particularly those in the domain of EV powertrain components. Several European companies are successfully supplying to both European and Chinese OEMs with the latter contributing up to 45% of the orders for these suppliers.

Are you interested in knowing more?

Contact CLEPA Communications Team at communications@clepa.be

Subscribe now to receive CLEPA’s latest communication

Attachments

In: CLEPA News