Automotive supply industry confidence picks up considerably – CLEPA Pulse Check

- Profitability expected to stabilise on back of growing order intake

- Sentiment positive despite hindrances in supply of semiconductors and other critical materials

- Nine out of ten suppliers are reviewing and adapting product portfolio

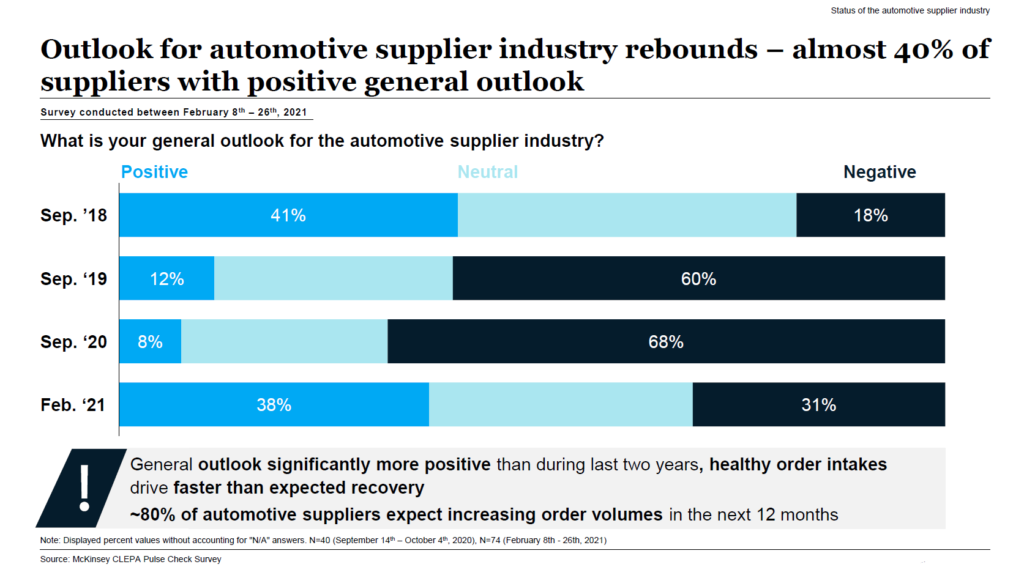

Automotive suppliers have become significantly more optimistic with their outlook on 2021, with 38% of surveyed suppliers showing positive forecasts compared to just 8% six months ago. Yet, 31% of respondents still hold a notably negative view, a much higher share than in pre-Corona times. This follows from the latest CLEPA Pulse Check survey on business sentiment in the sector, held late February into early March.

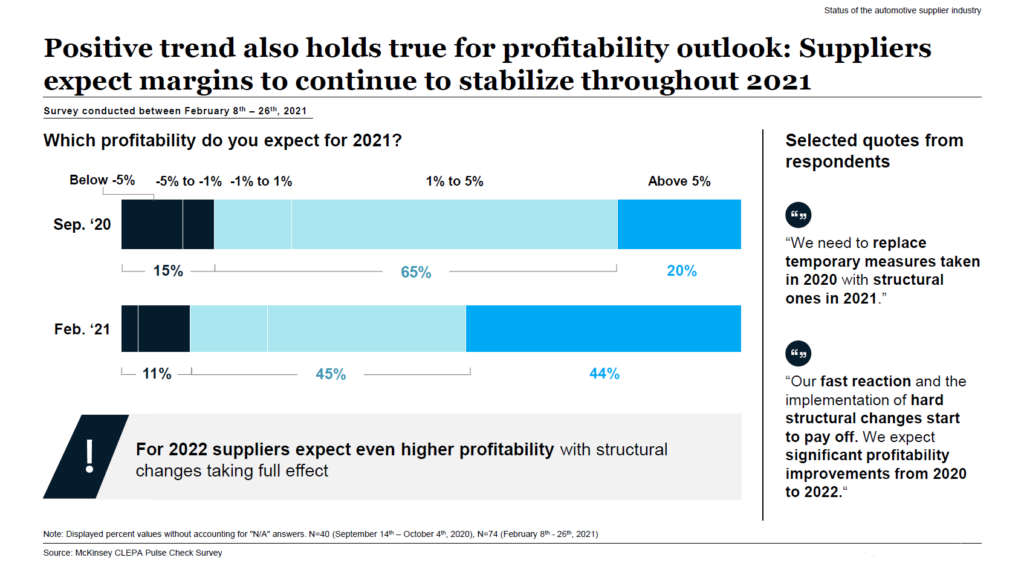

The majority outlook is robust in response to the much faster than expected rebound of the global automotive market, with four out of five suppliers expecting to increase order volumes in the next 12 months. Profitability is foreseen to stabilise further, with numbers above 5% in reach for over four out of ten respondents again.

“Sentiment is improving despite the continued concern on the impact of the pandemic and the current difficulties with deliveries of semiconductors and other critical materials, like steel and plastics, and constraints in transport and logistics capacity, all of which do have a dampening effect”, said Sigrid de Vries, CLEPA Secretary General. Over 60% of respondents in fact indicate to be impacted by these difficulties, resulting in delayed or interrupted production.

Respondents acknowledged that the semiconductor crisis has unveiled flaws in the just-in-time supply chain management. This has been compounded by low upfront chip commitment, and competing with strong demand in consumer electronics and a saturated capacity with base-chip manufacturers. Short-term recovery is not expected before at least another 3 months, and concerns are raised about the traditionally strong consumer demand in the third and fourth quarters ahead of Christmas shopping. De Vries: “Suppliers and OEMs must work to increase their visibility on demand along the whole chain and leverage the rapidly growing automotive demand toward other sectors.”

Situation on the ground

A closer look at the overall sentiment reveals a considerable number of both bullish and more bear-sighted respondents, with the share of neutral views fading. De Vries: “The situation on the ground differs depending on exposure to global markets, impact of the COVID-19 crisis, level of advancement towards new opportunities in connected and automated driving and alternative powertrain solutions including electric motors, axles and battery management systems, and the need to manage change in a shrinking market.” The rebound in order volumes is mainly seen in China and the US, with Europe lagging behind.

The pandemic is accelerating the structural transformation of the sector on the road to digital and carbon-neutral mobility, which had already started before 2020. “During the crisis, many companies have drastically cut costs and these measures are now paying off. With expectations on the pace of the economic recovery in 2021 until only recently having been much more modest, companies now see their order books filling up fast, allowing for an uptake in investment spending and planning.”

Dramatic change

Market watchers agree that the need for further structural measures has not gone away. “The race to stay competitive is on, and there will be winners and losers as a result. This is indeed visible in the CLEPA Pulse Check. Only 4% of respondent do not foresee dramatic change in their businesses in the next 5 years. This number has not yet been so low”, added De Vries.

Change is expected to culminate in further consolidation of the sector (70% of respondents rank this number one). 68% refer to an expected shift in profit pools from traditional components to software. Half of respondents point at the increasing importance of activities involving key high-tech components.

So-called sunset components are believed to become even more commoditised with lower margins resulting consequently. For those active in combustion engine related technology, the increasing demand for electrified solutions puts significant pressure on their business model. With global automotive volumes not foreseen to reach beyond 100 million units again any time soon, the overall pie is also shrinking.

Portfolio shift

For many, the challenge is to maintain revenues while making substantial investment in alternative solutions, without an immediate return in sight. The demand for electrified vehicle is increasing but the overall share in sales is still modest, reaching 11% of market share in Europe in 2020. The same applies to smart mobility and connected services. The fight for a part of the future share is, however, taking place right now.

Nine out of ten suppliers are currently reviewing and adapting their product portfolios. The Pulse Check reflects the various strategies they currently deploy to manage change. Foremost, 61% of respondents ranked in-house development of new technologies a priority, secondly, 51% opt for a change of strategic focus within the existing portfolio, with consolidation and mergers and acquisitions ranking almost equally third (32%) and fourth (29%). Interestingly, half of suppliers also actively explore markets for their technology solutions outside of the automotive realm, notably in household appliances and charging solutions.

CLEPA performs the Pulse Check survey twice a year, surveying CLEPA members with the support of McKinsey who aggregate the data.

Attachments

In: CLEPA News, Growth & Competitiveness