Escalating trade conflicts threaten EU supply industry

For Europe’s supply industry, exports have been a lifeline in uncertain times. Since COVID, increased trade with the US has helped offset the sharp decline in Europe’s trade balance with China. Imports of Chinese automotive components (excluding batteries) have nearly doubled over the last five years, reshaping the sector’s supply chains. But now, a new challenge looms – one that could blow up a key pillar under the sector’s export-oriented strategy.

President Trump imposed tariffs of 25% on aluminium and steel this week, which include components made from these materials, including some used in the automotive industry. A further round of tariffs could hit European car and component exports into the US across the board. This threatens to upend one of the industry’s key pillars: the US alone accounts for one fourth of the EU’s trade surplus in automotive components. For European auto suppliers, these tariffs present an existential threat that could exacerbate job losses and further weaken investment.

The impact goes beyond potential tariffs on EU exports. The US decision to impose tariffs on trade from Mexico could hit European suppliers hard, as they have invested nearly €10 billion in Mexican production facilities over the last decade. With growing uncertainty in the North American market, European companies face tough choices – relocate production, absorb costs, or lose market share.

The shifting trade and investment relationship with both the US and China underscores an urgent reality: the EU must rethink its trade and investment strategy before it falls behind. Strengthening ties with key partners including the UK, South Korea, Japan and Mercosur-countries, will be as important as reinforcing investment in its own industrial base.

Yet, as Europe navigates these challenges, its investment in the green and digital transition remains weak. Foreign Direct Investment (FDI) fell to the lowest level in three years, while the US attracted over two times as much investment over the same period.

Squeezed between an “America First”-trade policy and China’s growing dominance, Europe finds itself at a cross roads. A bold emphasis on competitiveness, innovation and investment in EU value add will be needed to avoid that the future of automotive is made outside of Europe.

Nils Poel, Head of Market Affairs

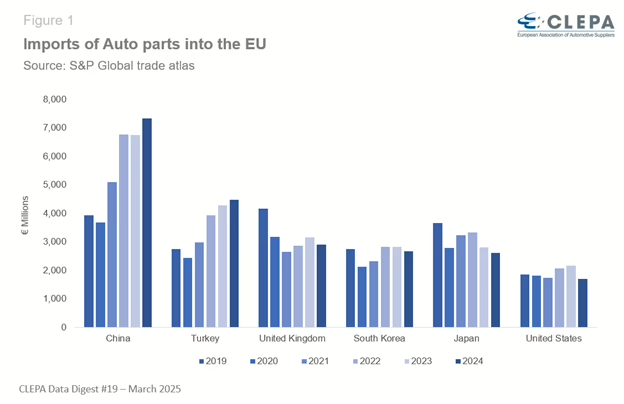

Reliance on China nearly doubles, while traditional partners lose ground

Europe’s reliance on China for automotive components is not limited to EV-related parts – it is increasingly reshaping the market for traditional components. Over the past five years, imports from China have practically doubled, rising from €3.9 billion to €7.3 billion, now making up a quarter of all EU automotive components imports.

Meanwhile, traditional partners such as South Korea, Japan and the US have seen their market share decline, with the UK’s share in EU automotive component imports falling sharply from 17% in 2019 to under 10% in 2024.

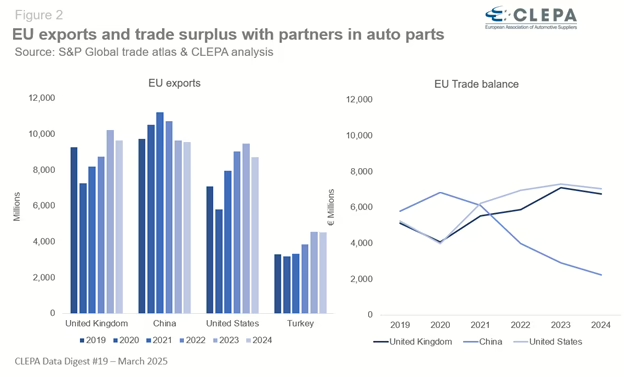

US responsible for one fourth of EU’s trade surplus

Over the past five years, strong exports to the US, totalling €8.7 billion, have helped sustain a solid trade surplus of €7 billion, making the US the largest contributor to Europe’s positive trade balance. However, the proposed 25% tariffs on EU cars sold in the US threatens to disrupt this status quo.

Meanwhile, Europe’s once-strong trade surplus with China has shrunk further to a record low of €2.2 billion, down from €7 billion in 2020.

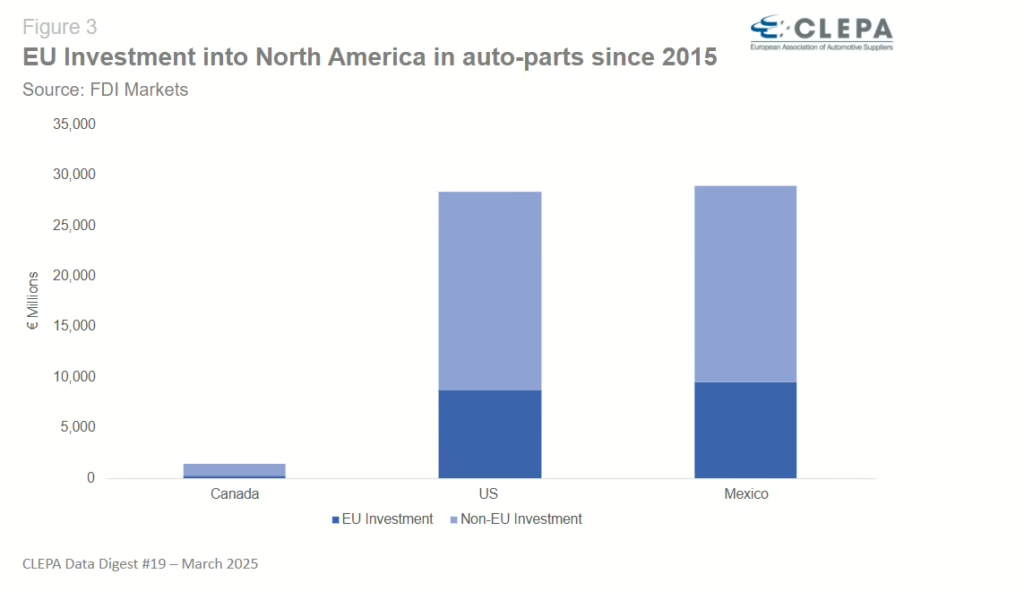

EU’s one-third share of North American automotive investments at risk from US tariffs

Over the past decade, European automotive suppliers have built a robust presence in North America, pouring €18.4 billion into the region – making up 31% of all automotive component investments. Mexico has emerged as a key hub for EU suppliers, with European companies contributing around one third (€9.5 billion) of the total foreign investment in the country.

In the US alone, nearly €8.7 billion has been invested in the automotive supply chain, creating approximately 35,000 jobs. However, with US tariffs threatening European vehicle exports and jeopardising supply chains in Mexico, the strategic investments made over the years could face serious disruption.

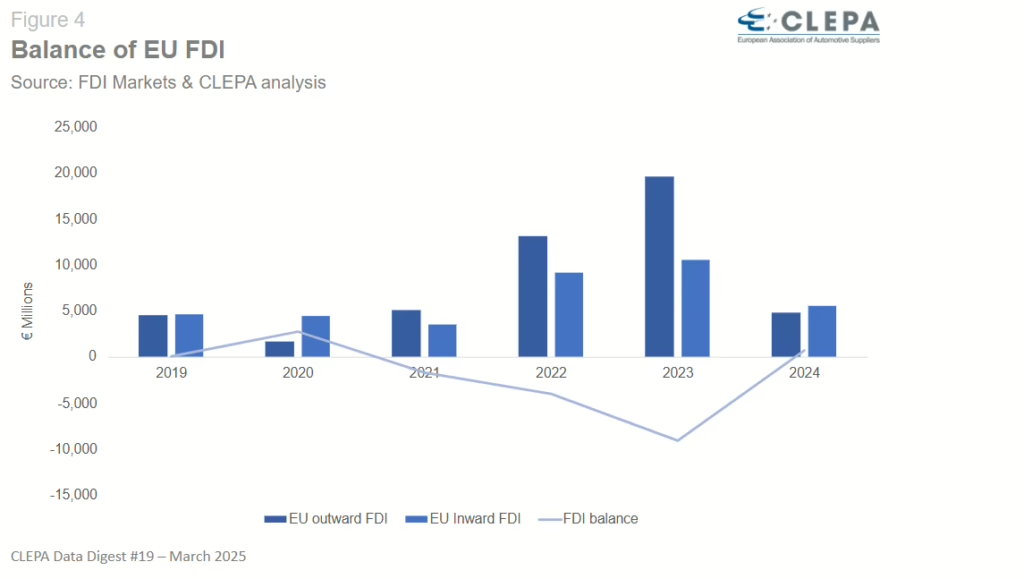

EU attracts lower investment in three years amid global downfall in investments

Foreign Direct Investment (FDI) in Europe’s automotive supply chain has shown improvement, with the EU securing 22% of all global investments in automotive components, batteries, and semiconductors. While this marks a relative recovery, the US remains the leader, attracting 28% of total inflows.

Battery-related investments have been the dominant trend in recent years, but both Europe and the US have seen a slowdown – EU investments fell by €4.7 billion, while the US experienced a drop of €11.5 billion. Europe, however, still lags behind the US in attracting investment in traditional automotive components, securing just €951 million flowing into the European sector compared to €2.9 billion across the Atlantic.

In 2024, the EU’s FDI balance shifted to a marginal surplus of €0.7 billion, a positive recovery from the €9 billion deficit recorded in 2023.

Benjamin Krieger, Secretary General

Contact CLEPA Communications Team at communications@clepa.be