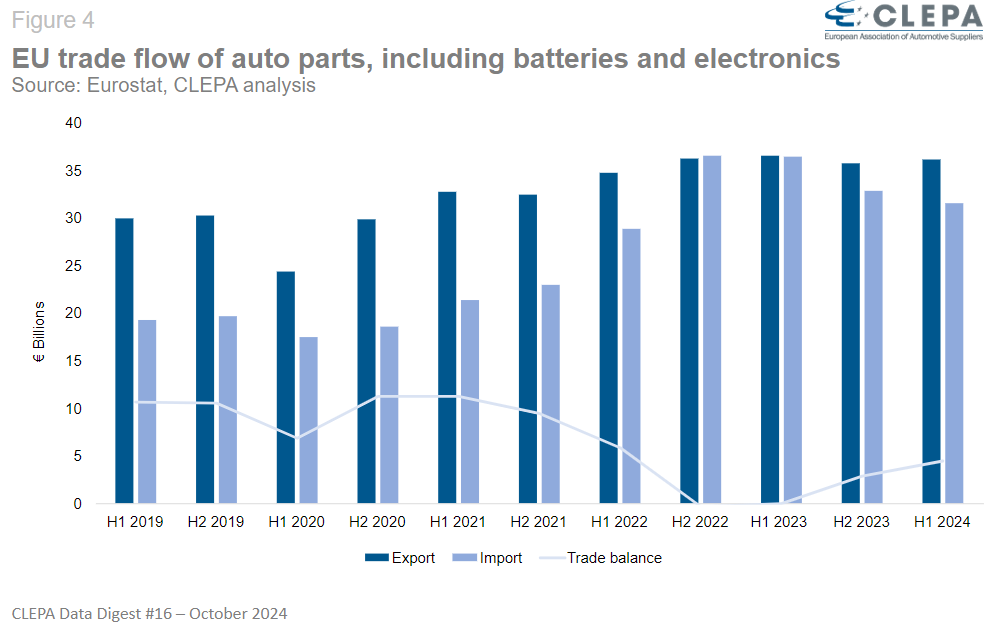

Trade balance steadies but transition could slip out of reach

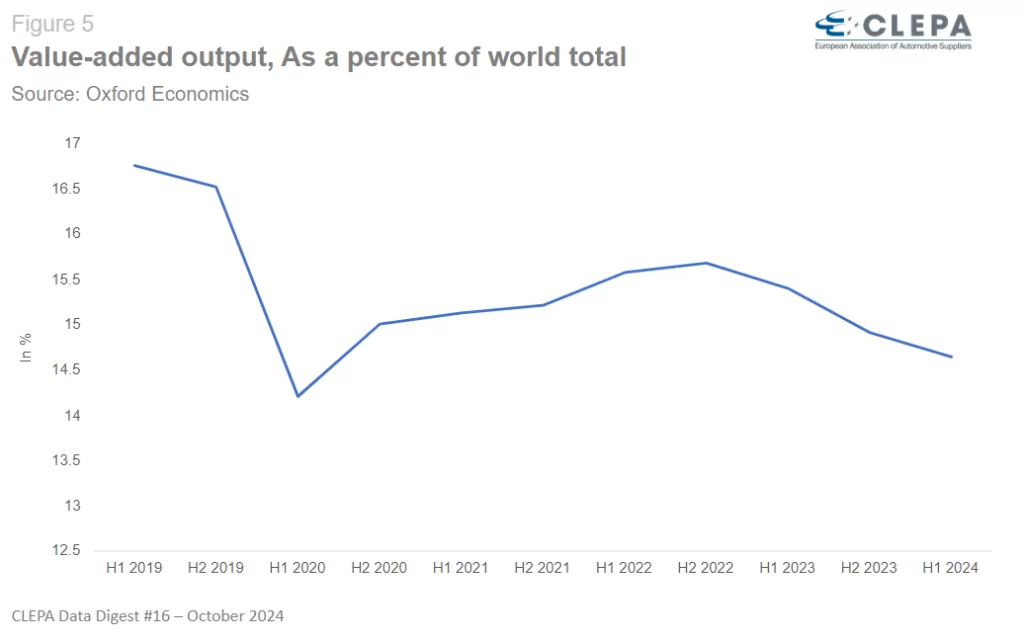

Despite some positive developments, including a modest recovery in the trade surplus driven by falling battery imports, the industry’s ability to fund and execute the necessary investments for a successful transition is waning. The EU’s competitiveness is increasingly under pressure, highlighted by a continued decline in its share of global automotive value creation—dropping to just 14.6% in the first half of 2024, down from 16.5% in 2019.

The persistent financial and structural difficulties raise urgent questions about Europe’s capacity to remain competitive in the global automotive landscape.

Nils Poel, Head of Market Affairs

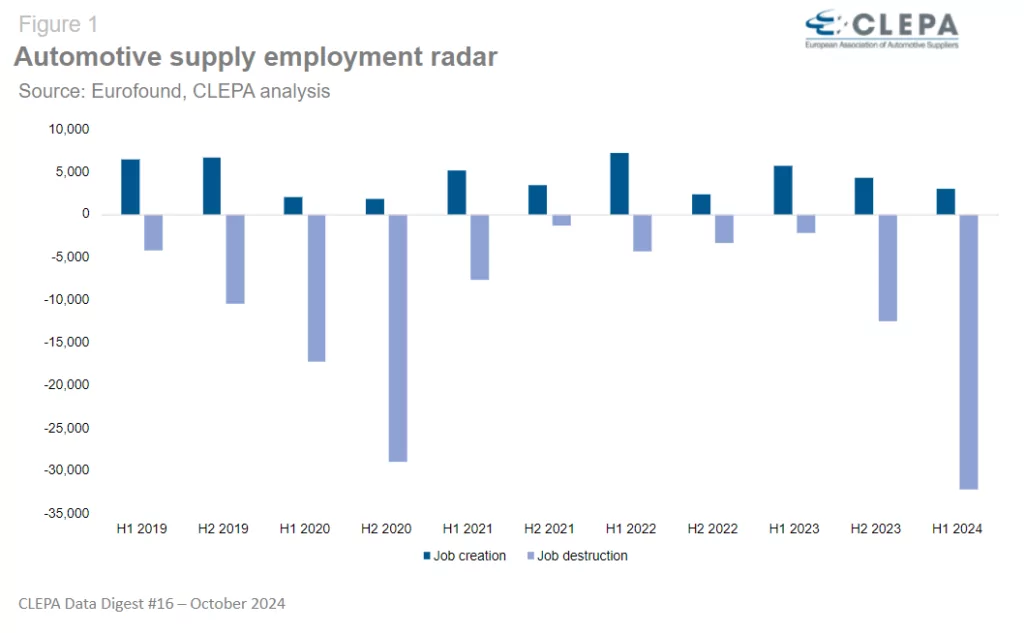

Job losses surpass COVID crisis levels

In the first half of 2024 alone, the industry announced 32,000 job cuts, surpassing the levels seen during the worst days of the COVID-19 crisis. This marks the second consecutive period where job losses have significantly outpaced job creation, with only 2,945 new jobs added in the first 6 months of 2024. Over the past five and a half years, the industry has announced the loss of at least 124,500 jobs while creating just 48,000 new ones. These figures are a clear signal that the industry’s structural health is in jeopardy, demanding immediate attention.

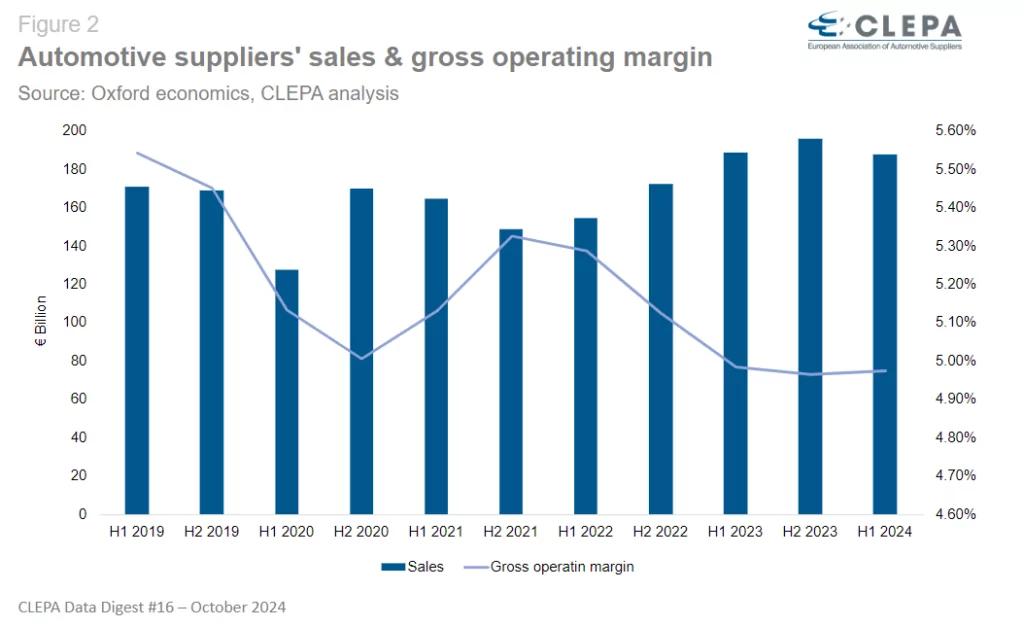

Profitability remains insufficient to sustain investments in twin transition

After a stretch of five periods of stable sales growth, the first half of 2024 ended on a down note, with sales dropping to €187.3 billion from €195.6 billion in the previous semester, or 4.6% less. In a large part of the industry, profitability remains below the crucial 5% threshold necessary to sustain investment. Gross operating margins have been declining since 2021, casting doubt on the industry’s ability to finance the investments required for a successful twin transition. While motor vehicle output remained steady at the start of the year, significant declines are now being recorded, with Germany down 7.3%, France –21.7%, and Italy -34.7% as of July 2024. This is not simply a financial issue, but a strategic threat that could leave Europe’s automotive industry behind in the global race for future mobility.

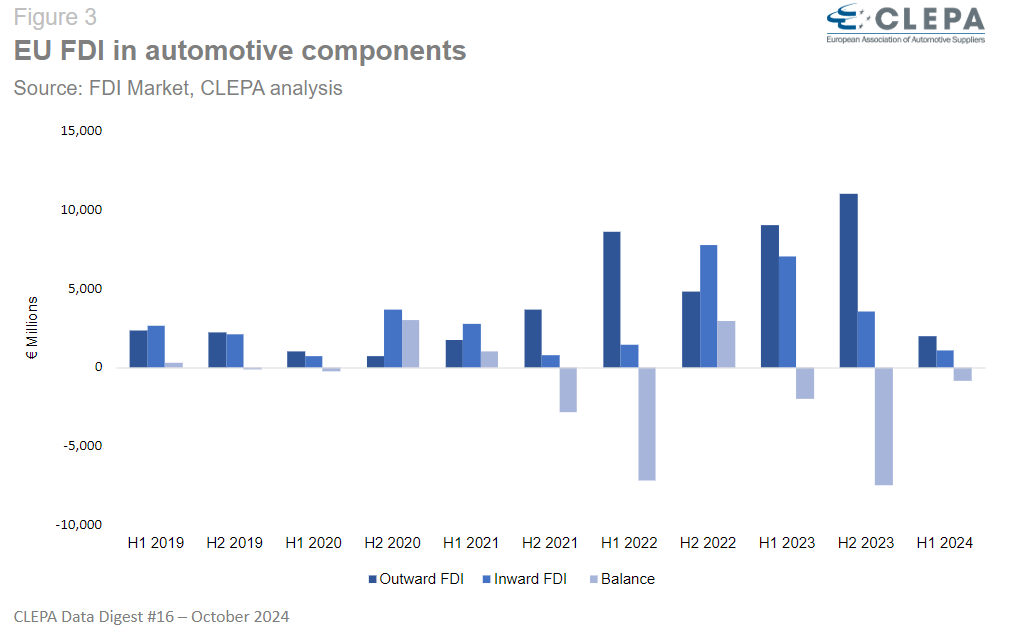

Progress on twin transition at risk as capital inflows dwindle

Foreign direct investment (FDI) trends reveal a concerning picture. For the second year in a row, inward investment in the EU automotive supply industry has lagged behind outward flows. The first half of 2024 was particularly weak, with inward investments stagnating at just €1.07 billion versus €3.22 billion on average for the period analysed. This growing FDI imbalance highlights the EU’s increasing dependency on external markets and underscores the challenges Europe faces in attracting the capital needed to sustain European automotive production.

Trade surplus shows signs of recovery as battery imports decline

The European automotive supply industry’s trade balance has remained positive, with a surplus of €4.5 billion in the first half of 2024. Despite a 19% drop in battery imports compared to the first half of 2023—primarily driven by weaker electric vehicle sales and only marginally by increased domestic battery production—the battery trade balance remains deeply negative, with a deficit of €6.5 billion. Semiconductor imports, though reduced, still added €1.67 billion to the deficit, highlighting the need to secure investment in critical automotive technologies.

European suppliers lose ground in global value creation

Europe’s share in global automotive value creation continues its downward trend, now standing at just 14.6%, a decline from 16.5% in 2019. While the post-COVID period raises hopes for recovery, this steady loss of market share, driven primarily by the rapid expansion of the Chinese automotive sector, raises urgent questions about Europe’s competitiveness and long-term strategic positioning in the global market.

Benjamin Krieger, Secretary General

Contact CLEPA Communications Team at communications@clepa.be